Understanding The New U.S. Reciprocal Tariffs: What You Need To Know

The landscape of international trade is constantly evolving, and the latest tariff changes introduced by the United States are poised to have a significant impact on global ecommerce. With new duties being imposed on various imported goods, business and consumers alike must understand these standards, these changes, and how they can affect relations worldwide. In this blog, we will break down the key aspects of the new U.S. reciprocal tariffs, which aim to level the playing field with trading partners imposing higher tariffs on U.S. exports.

New U.S. Tariffs: An Overview

The United States has announced a series of additional tariffs to take effect in April and May of 2025. These tariffs are in addition to the existing duties and are designed to address trade imbalances by introducing reciprocal tariff rates on countries that impose higher tariffs on U.S. goods.

The major changes include:

Automotive Tariffs: A 25% tariff will be imposed on imported passenger vehicles and light trucks from all countries, effective April 3, 2025. Auto parts will be facing the same tariff of 25% starting May 3, 2025.

Universal Baseline Tariff: Beginning April 5, 2025, there will be a 10% additional duty to nearly all imported products, except those that are already in transit before this date.

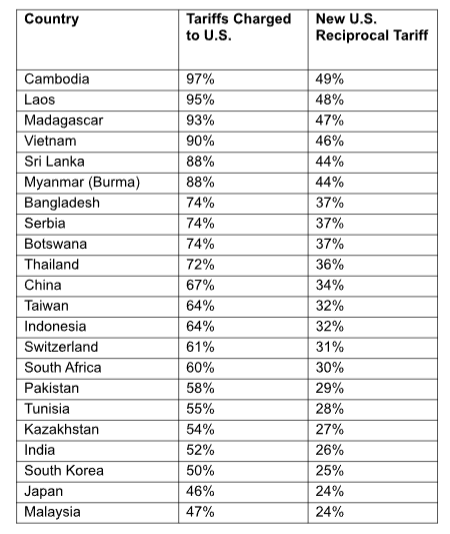

Reciprocal Tariffs: As of April 9, 2025, individualized reciprocal tariffs will be implemented on imports from approximately 60 countries. These tariffs are aimed at aligning U.S. duties with those charged by foreign nations on U.S. exports.

De Minimis Rule Changes: Starting May 22, 2025, the U.S. will eliminate duty-free treatment for low-value imports from China, impacting businesses that rely on small-scale imports.

Industries Most Affected

Several industries will be heavily impacted by these tariff adjustments:

Automotive Sector: The 25% tariff on passenger vehicles and light trucks will likely drive up the prices for both consumers and manufacturers that rely on imported components.

Retail and E-Commerce: Companies sourcing low-value goods from China will need to adjust their supply chain strategies due to the elimination of duty-free treatment.

Manufacturing and Heavy Industry: The reciprocal tariffs will affect industries importing raw materials or semi-finished goods from affected countries.

Looking Ahead: Preparing for the Future of Trade

The new U.S. tariff policies mark a strategy shift in international trade, aiming to create a fair landscape for American businesses. While these tariffs can protect domestic industries, they pose a challenge for importers and consumers who may face higher prices. As these polices take place, businesses must reassess their supply chain and develop strategies to navigate the evolving trade environment. For more information on how to navigate the new polices, do not hesitate to contact our experts at Bruning International!